Are Teachers’ Pensions Fueling the Climate Crisis?

OPINION

By Karen Weisberg and Lisa Jeffery

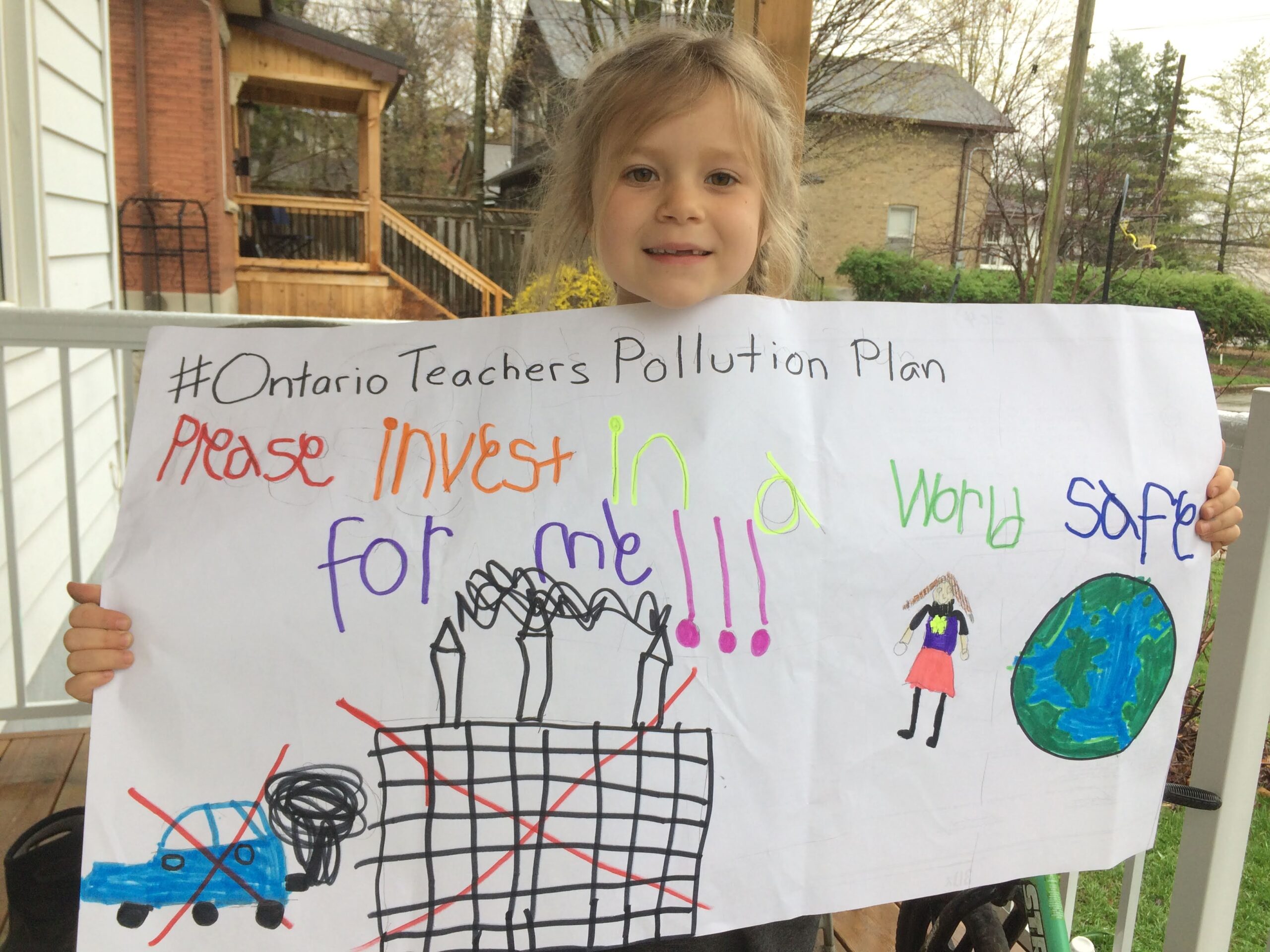

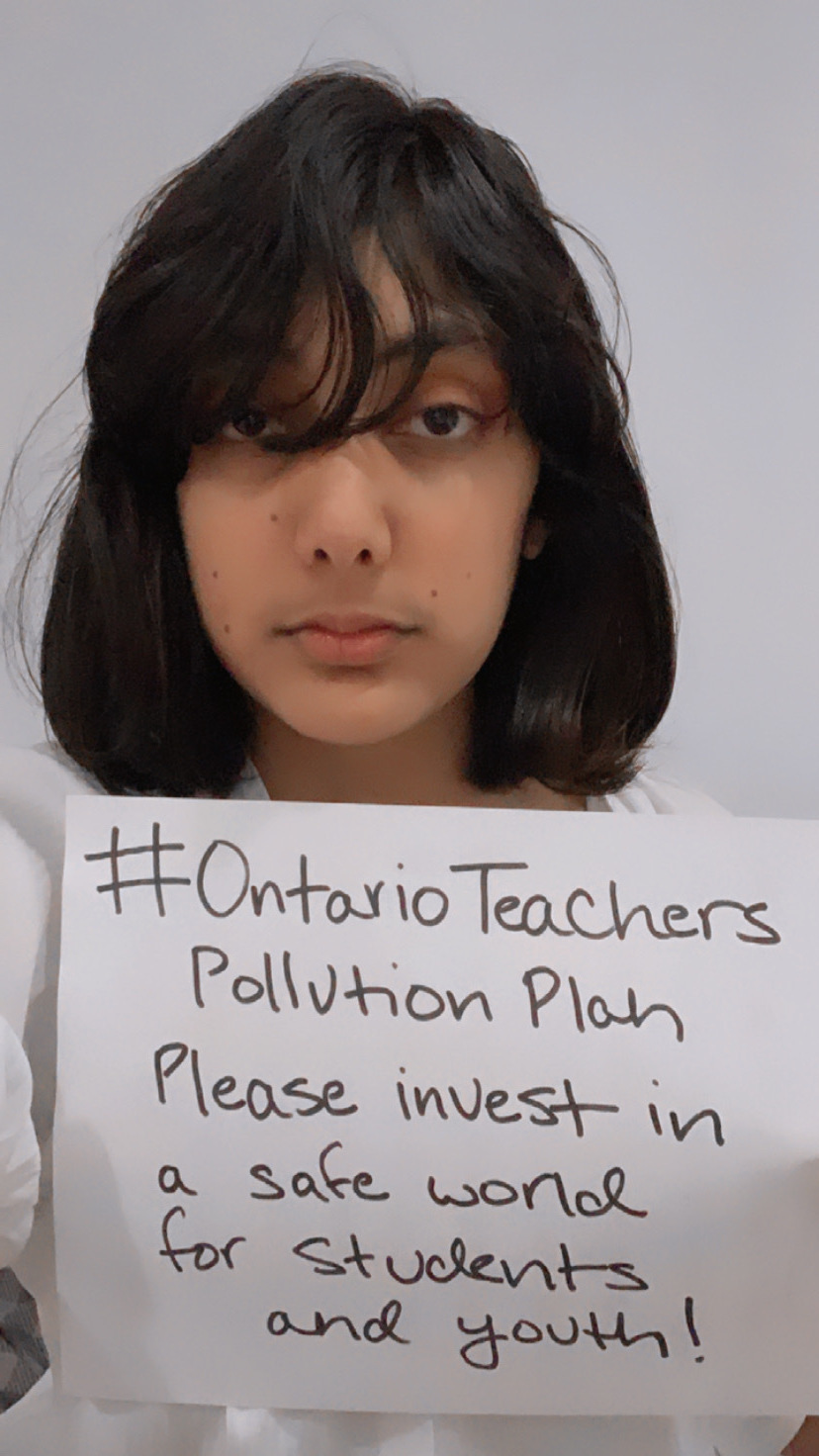

Images provided by Patrick DeRochie

As heatwaves, wildfires, droughts, floods, and other extreme weather events ravage communities in our home province of Ontario and around the world, a growing number of teachers and students are demanding that teachers’ pension funds stop investing their retirement savings in the fossil fuel companies that are most responsible for the climate emergency.

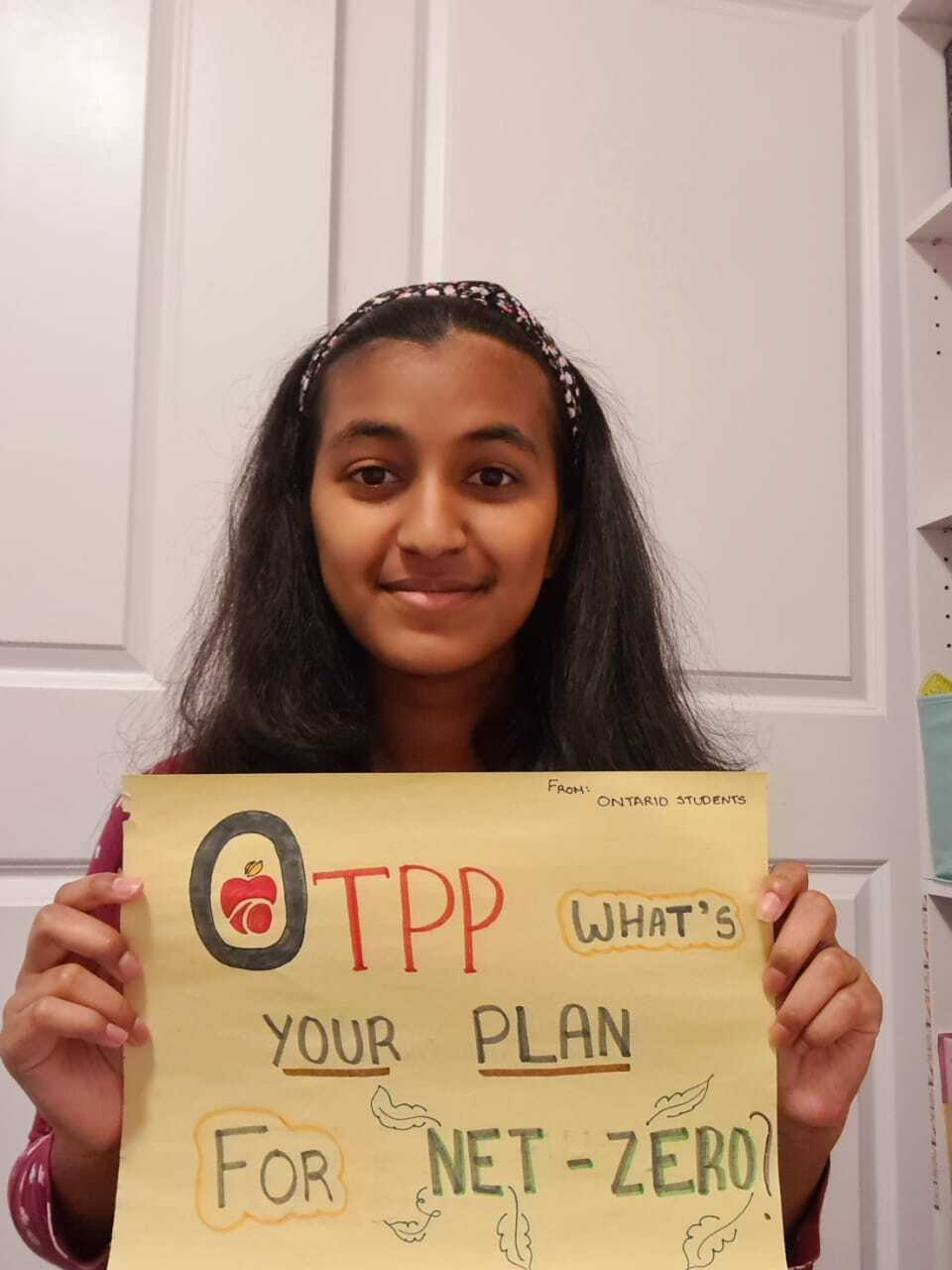

This new and innovative avenue for climate action protects teachers’ pensions from the growing financial risks of climate change and shifts billions of dollars out of fossil fuels and into climate solutions. Teachers in some American cities and states have already convinced their pension funds to stop investing in fossil fuels, and students and teachers in Canada are pushing the massive Ontario Teachers’ Pension Plan (OTPP) to do the same.

Many teachers are looking for new ways to tackle the climate crisis, both at home and at school. They’re starting student climate action clubs, proposing environmental education ideas for the curriculum, and leading initiatives to make their schools greener and more energy efficient. But there’s a critical avenue for climate action that teachers might not think about: their pension funds.

Teachers’ pension funds are some of the largest institutional investors in the world. The investment decisions these pension funds make can affect how quickly we move away from climate-wrecking fossil fuels and build a zero-carbon economy.

Teachers’ pension funds are some of the largest institutional investors in the world. The investment decisions these pension funds make can affect how quickly we move away from climate-wrecking fossil fuels and build a zero-carbon economy.

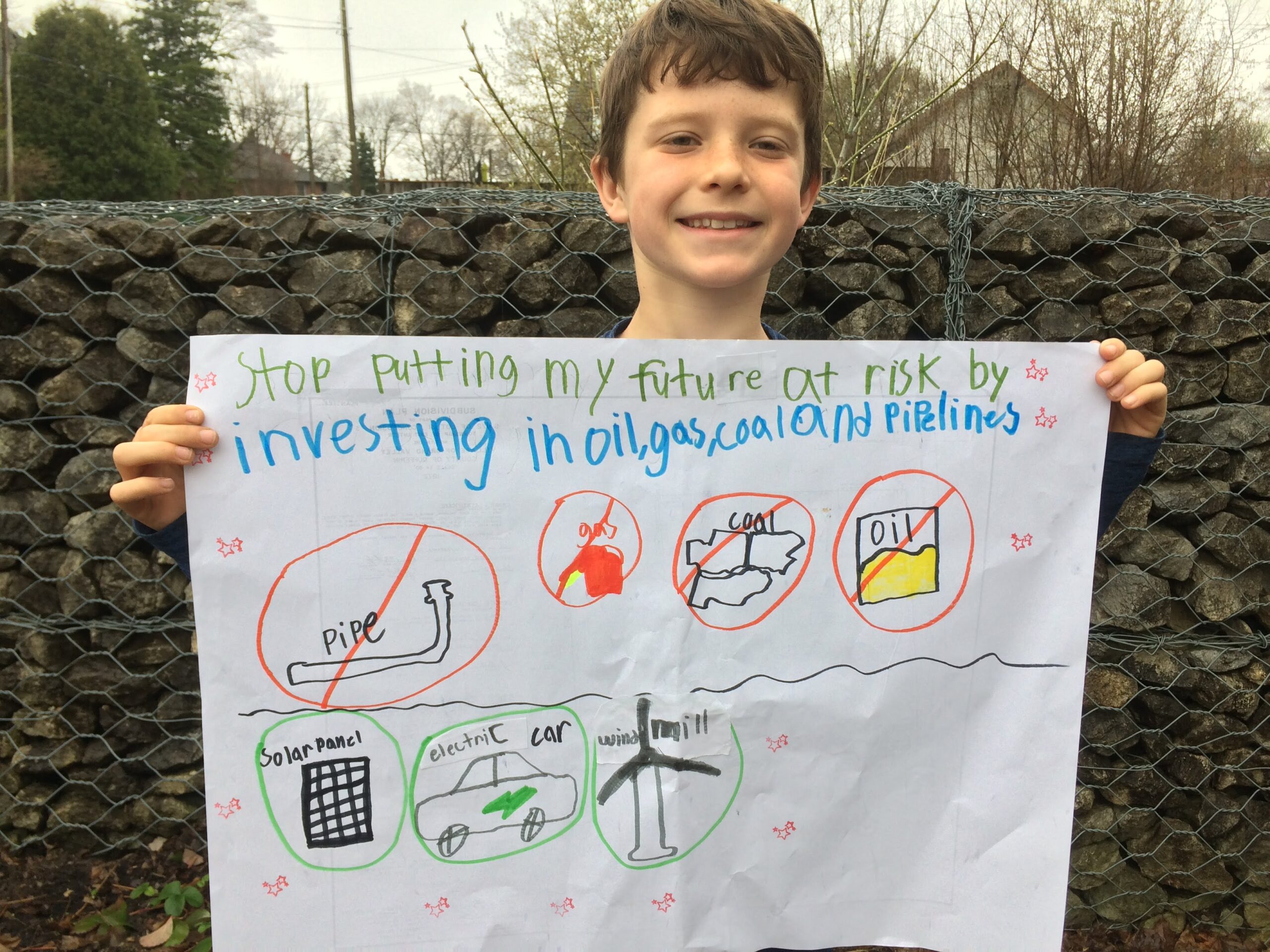

Many teachers might simply be glad to have a pension and might not think about how it’s being invested. But when teachers learn that their retirement savings are being invested in the primary causes of the climate crisis, like oil, gas, coal, and pipelines, they’re often outraged.

We think it’s morally wrong for teachers’ pensions to be invested in companies that are undermining a safe climate future for their students. We’re proud of our careers spent educating students and preparing young people for the future. It’s unacceptable to us that our pension is being invested in infrastructure and companies whose business plans would result in fossil fuel use far exceeding the limits needed to meet our Paris targets.

But aligning teachers’ pension funds with climate safety isn’t just about morality. It’s also a smart financial decision, since investing in profitable climate solutions protects teachers’ pension savings from the financial risks of climate change and helps to build the zero-carbon economy that’s needed to ensure their own retirement security and their students’ futures.

Like all pension funds, the OTPP has a fiduciary responsibility to invest in our best financial interests. This legal obligation pertains to both retired teachers who finished teaching years ago and working teachers who won’t start collecting their pensions until well into the second half of this century.

Having taught for our entire careers in Ontario, we are members of the OTPP. It’s the largest single-profession pension plan in Canada and one of the largest retirement funds in North America, with C$242.5 billion in assets under management. Like many large Canadian public pension plans, the OTPP isn’t just a savings account collecting interest every year. It’s a sophisticated, professionally managed investment fund with assets all over the world. In addition to a portfolio of stocks, bonds, and all kinds of financial products, it owns significant parts of the real economy — highways, bridges, hospitals, ports, shopping malls, office and residential buildings, utilities, airports, and entire companies across every sector of the economy.

The OTPP is taking some laudable measures to manage the risks that the climate crisis is creating for our retirement savings. It has committed its portfolio to net-zero emissions by 2050, considers climate change in its investment decisions, encourages companies to cut their carbon pollution, and invests billions of dollars in climate solutions like renewable energy, green buildings, and sustainable agriculture.

But the OTPP is also a major investor in fossil fuels. Earlier this year, the OTPP’s CEO reported that three per cent of our pension portfolio — or C$7.4 billion — was invested in oil and gas exploration. In the 18 months between when it committed to net-zero emissions in January 2021 and June 30, 2022, Ontario Teachers’ has increased the number of shares it holds in fossil fuel companies by 80 per cent. In some cases, the OTPP outright owns entire fossil fuel companies, such as oil and gas producers in Alberta and Texas; fossil gas pipeline networks in the United Kingdom, Italy, and Washington state; and other high-carbon infrastructure like a portfolio of airports in Europe and the United Kingdom.

The OTPP also has some troubling corporate entanglement with fossil fuel interests. As of March of 2022, 12 investment managers and senior staff at the OTPP held 19 different roles, and previously held six different roles, with 15 different fossil fuel companies. One of the trustees responsible for overseeing our retirement portfolio sat on the board of directors of one of the largest producers of fossil gas in Canada for 13 years. In September, the OTPP announced the appointment of a new trustee who sits on the board of four different fossil fuel companies. How can someone who has a legal duty to invest in our best interests simultaneously have a legal responsibility to maximize profits for oil and gas companies? It’s like having a cigarette company executive sit on the board of public health and then expecting us to believe this has no impact on anti-smoking campaigns.

The OTPP also has some troubling corporate entanglement with fossil fuel interests. As of March of 2022, 12 investment managers and senior staff at the OTPP held 19 different roles, and previously held six different roles, with 15 different fossil fuel companies. One of the trustees responsible for overseeing our retirement portfolio sat on the board of directors of one of the largest producers of fossil gas in Canada for 13 years. In September, the OTPP announced the appointment of a new trustee who sits on the board of four different fossil fuel companies. How can someone who has a legal duty to invest in our best interests simultaneously have a legal responsibility to maximize profits for oil and gas companies? It’s like having a cigarette company executive sit on the board of public health and then expecting us to believe this has no impact on anti-smoking campaigns.

As the impacts of the climate crisis get worse and worse, the science is indisputable: If we are to limit global temperature increase to 1.5 degrees Celsius and prevent a climate catastrophe, the production and combustion of fossil fuels must rapidly come to an end. Authoritative bodies like the Intergovernmental Panel on Climate Change and the International Energy Agency are clear that achieving this Paris agreement goal requires an immediate end to fossil fuel expansion and a rapid phase-out of oil, gas, and coal.

Thankfully, a growing number of teachers are organizing to tackle their pensions’ petroleum problem.

In Ontario, a large and growing group of working and retired teachers are calling on the OTPP to do what’s necessary to protect their pensions and the climate, by ending investment in fossil fuels. In 2018, the Elementary Teachers’ Federation of Ontario passed a resolution calling on their union leaders to tell the OTPP to divest and refrain from new investments in fossil fuel companies. More recently, teachers have sent letters to their pension managers and union leaders, made climate change a central issue at OTPP AGMs, written op-eds in Ontario newspapers, and formed an organized provincial network called #ShiftOTPP. Teachers are also working with students from the Fridays for Future movement, who made a video calling on the OTPP to stop wrecking their future by investing their teachers’ retirement savings in fossil fuels.

The demands of Ontario teachers for climate leadership from their pension funds are similar to those popping up all over North America and around the world:

The demands of Ontario teachers for climate leadership from their pension funds are similar to those popping up all over North America and around the world:

- The New York City Teachers’ Retirement System is already divesting from the largest corporate owners of fossil fuel reserves in the world, while the New York State Teachers’ Retirement System has restricted additional investments in new fossil fuel investments and is divesting its coal assets.

- In October, the board of the Chicago Public School Teachers’ Pension & Retirement Fund approved a resolution to divest from fossil fuel companies by the end of 2027, calling the commitment “in compliance with our mission to provide, protect, and enhance the present and future well-being of members, pensioners, and beneficiaries.”

- Maine’s state legislature passed a law last year requiring the Maine Public Employee Retirement System (the pension fund for teachers in Maine) to divest from fossil fuels by 2026.

- Teachers in California are pushing for a similar state law that would require the California State Teachers’ Retirement System to divest from fossil fuels.

- The American Teachers Federation, the United States’ second largest teachers’ union, overwhelmingly passed a resolution in July urging all teachers’ pension trustees to divest members’ retirement funds from fossil fuels and reinvest in climate solutions that benefit displaced workers and frontline communities.

- In Canada, the British Columbia Teachers’ Federation overwhelmingly passed a resolution this spring calling on the British Columbia Teachers’ Pension Plan to divest from fossil fuels.

- In Europe, Paedagogernes Pension, the pension fund for early childhood teachers in Denmark, banned investment in 144 fossil fuel companies in 2020.

- In Australia, the leading superannuation fund for the education and community sectors, NGS Super, announced in August that it would divest from and end future investments in fossil fuels.

Fossil fuel divestment is now mainstream, with over US$40 trillion of asset managers at least partly restricting investment in oil, gas, and coal. This includes 187 pension funds.

It’s morally unacceptable and financially risky for teachers’ retirement savings to be invested in risky oil, gas, coal, and pipeline companies that are compromising a safe climate future for teachers and students alike.

It’s morally unacceptable and financially risky for teachers’ retirement savings to be invested in risky oil, gas, coal, and pipeline companies that are compromising a safe climate future for teachers and students alike.

What teachers can do

- In Ontario, teachers can take the first step and send a letter to their pension managers, trustees, and union leaders using this action tool.

- In the United States, the Climate Safe Pensions Network includes campaigns in 12 different states calling for an end to pension investments in fossil fuels.

Working and retired teachers can also ask their pension managers for more information about how their retirement savings are being invested and educate themselves on the process. You can talk to friends and colleagues about how their pension funds are contributing to the climate crisis. You can contact your union local or retired teachers’ association with your climate-related pension concerns or submit proposals at teachers’ union conventions calling for fossil fuel divestment. You can also write op-eds and letters-to-the-editor, write directly to your pension managers, start or share a petition specific to your pension fund, or connect with local environmental groups who are already taking action on the role financial institutions play in causing and addressing the climate crisis.

We urge environmentally minded teachers in Ontario and across North America to join us in calling on our pension funds to stop investing in fossil fuels and invest in a safe climate future.

Karen Weisberg is a retired teacher in Toronto, Ontario, Lisa Jeffery is a secondary science teacher in Leamington, Ontario.

Leave a Reply

You must be logged in to post a comment.